Car Insurance Rates in California: Understanding, Comparing, and Finding the Best Deals

What do you mean by car insurance rates?

Car insurance rates refer to the premiums that drivers pay to insurance companies in exchange for coverage against potential damages, losses, or liabilities resulting from accidents or other unforeseen events. These rates are determined by various factors, including the driver’s age, driving history, location, type of vehicle, and coverage options chosen.

How are car insurance rates calculated?

Car insurance rates in California are calculated based on several key factors. These include:

– Driver’s demographic information: Age, gender, marital status, and occupation can impact insurance rates. Younger and inexperienced drivers often face higher premiums due to their perceived higher risk.

– Driving record: A clean driving record with no accidents or traffic violations can lead to lower rates, while a history of accidents or tickets may increase premiums.

– Vehicle type and usage: Insurance companies consider the make, model, age, and safety features of the vehicle. The purpose of the vehicle, such as personal or commercial use, also affects rates.

– Location: Insurance rates vary based on the location of the insured vehicle. Urban areas with higher population densities and increased risk of theft or accidents typically have higher premiums.

– Coverage options: The level of coverage chosen, including liability, collision, comprehensive, and additional add-ons, impacts the overall cost of insurance.

– Credit score: In some states, including California, insurance companies are allowed to consider credit scores when determining rates. A lower credit score may lead to higher premiums.

What is known about car insurance rates in California?

Car insurance rates in California are known to be among the highest in the country. The state’s high population density, heavy traffic, and a higher-than-average number of uninsured drivers contribute to these increased rates. Additionally, California’s stringent regulations and mandatory coverage requirements further impact insurance costs.

According to a study by Insure.com, the average annual car insurance premium in California is approximately $1,962, significantly higher than the national average of $1,548. However, it’s important to note that these rates can vary significantly depending on individual factors, such as driving history and location within the state.

California law requires drivers to maintain minimum liability coverage of $15,000 for injury or death of one person, $30,000 for injury or death of multiple people, and $5,000 for property damage. These requirements aim to protect individuals and ensure that they can cover potential damages or medical expenses resulting from accidents.

Solutions for finding affordable car insurance rates in California

While car insurance rates in California may be high, there are several strategies to help drivers find more affordable coverage options:

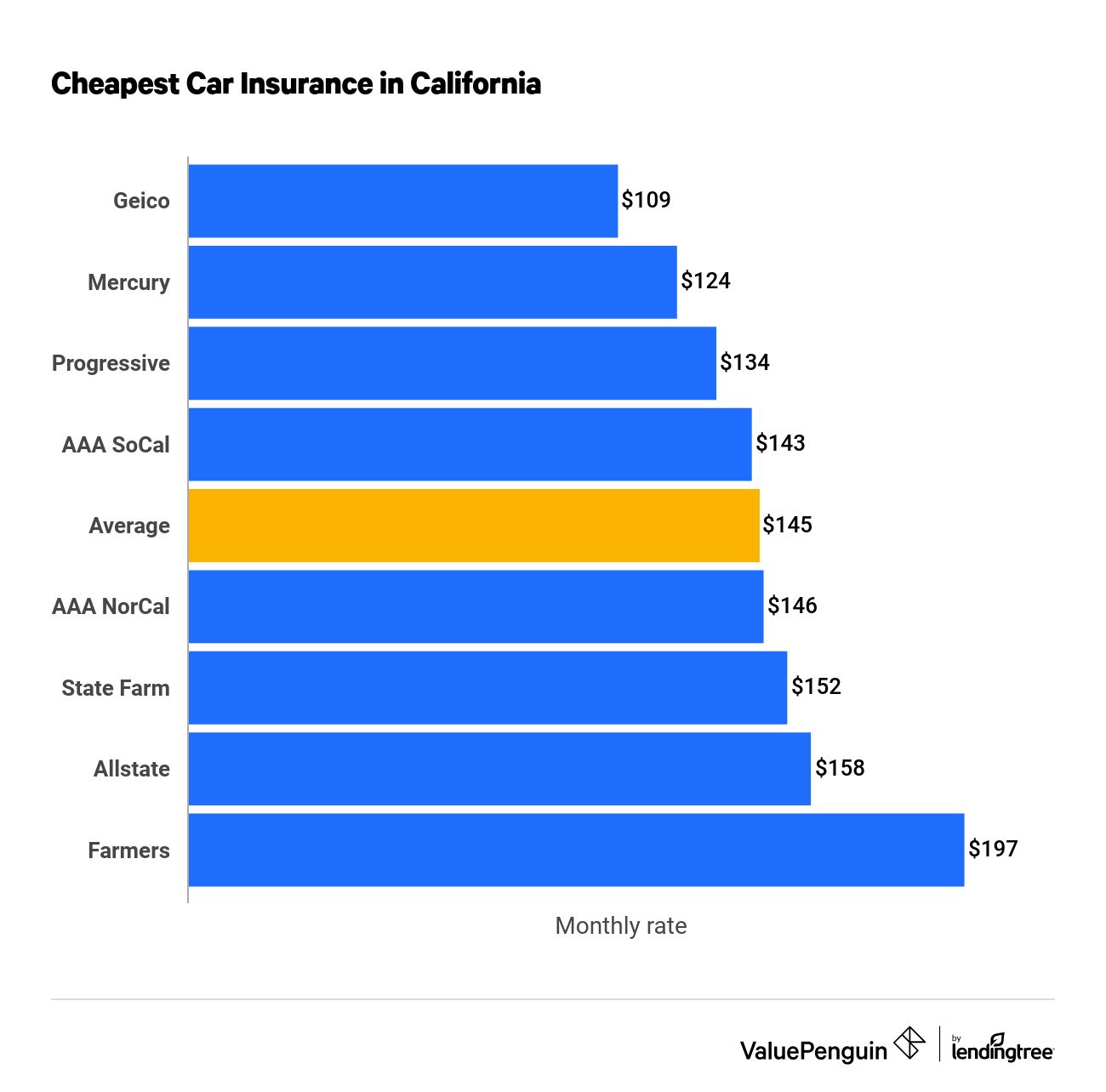

1. Shop around and compare rates: It is essential to obtain quotes from multiple insurance companies and compare their offerings. Each company has its own methodology for calculating rates, so exploring different options can help identify the best deals.

2. Maintain a clean driving record: Safe driving habits, free from accidents and traffic violations, can lead to lower insurance rates. Adhering to traffic laws and practicing defensive driving techniques can help keep premiums affordable.

3. Bundle policies: Many insurance companies offer discounts for bundling car insurance with other policies, such as homeowner’s or renter’s insurance. Consolidating coverage with one provider can result in significant savings.

4. Increase deductibles: Choosing a higher deductible can lower monthly premiums. However, drivers should ensure they can comfortably afford the deductible amount in case of an accident.

5. Take advantage of discounts: Insurance companies often provide various discounts, such as those for good students, low annual mileage, safe driving courses, or vehicle safety features. Researching and utilizing these discounts can help reduce overall insurance costs.

6. Improve credit score: As credit score can impact insurance rates in California, maintaining a good credit history can contribute to more favorable premiums. Paying bills on time, reducing outstanding debts, and monitoring credit reports for inaccuracies can all help improve credit scores.

Information about car insurance rates in California

When searching for car insurance rates in California, it’s important to consider the following information:

– Minimum coverage requirements: Familiarize yourself with the state’s minimum liability coverage requirements to ensure compliance with the law.

– Coverage options: Understand the different types of coverage available, such as liability, collision, comprehensive, uninsured/underinsured motorist coverage, and personal injury protection. Evaluate your needs and budget to determine appropriate coverage levels.

– Additional add-ons: Insurance companies offer various add-ons, such as roadside assistance, rental car coverage, or gap insurance. Consider these options to enhance your coverage as needed.

– Deductibles: Determine the deductible amount you are comfortable with. Higher deductibles typically result in lower premiums but require higher out-of-pocket expenses in case of a claim.

– Payment options: Inquire about the available payment plans and methods to ensure they align with your financial preferences.

Conclusion

Understanding car insurance rates in California is crucial for drivers to make informed decisions and find the best coverage at affordable prices. While the state’s rates may be higher than the national average, exploring different insurance options, maintaining a clean driving record, utilizing discounts, and considering various cost-saving strategies can help mitigate the financial impact. By being proactive and well-informed, drivers can find suitable car insurance options that provide the necessary coverage without breaking the bank.

FAQs (Frequently Asked Questions)

1. Can my car insurance rates in California be affected by my credit score?

Yes, in California, insurance companies are allowed to consider credit scores when determining rates. A lower credit score may lead to higher premiums.

2. How can I get affordable car insurance rates in California?

To find affordable car insurance rates in California, it is recommended to shop around, compare quotes from multiple insurers, maintain a clean driving record, bundle policies, increase deductibles, and take advantage of available discounts.

3. What factors impact car insurance rates in California?

Several factors influence car insurance rates in California, including age, gender, driving record, vehicle type, location, coverage options, and credit score.

4. Are car insurance rates in California higher than the national average?

Yes, car insurance rates in California are known to be higher than the national average due to factors such as population density, traffic, and mandatory coverage requirements.

5. How can I ensure I have adequate car insurance coverage in California?

To ensure adequate coverage, familiarize yourself with California’s minimum liability requirements, understand different coverage options, evaluate your needs, and consider additional add-ons based on your specific situation.