Car Insurance California Quotes

What do you mean by car insurance california quotes?

Car insurance California quotes refer to the estimated prices or premiums offered by insurance companies for auto insurance coverage in the state of California. These quotes provide an estimate of the cost of insuring a vehicle based on various factors such as the driver’s age, driving history, type of vehicle, and desired coverage options. Obtaining car insurance quotes allows drivers to compare different insurance providers and select the most suitable coverage at an affordable price.

How to obtain car insurance California quotes?

Obtaining car insurance California quotes is a relatively straightforward process. There are several methods you can use to get car insurance quotes:

1. Online Insurance Comparison Websites: Many websites allow you to compare quotes from multiple insurance providers at once. Simply enter your information and desired coverage options, and the website will generate quotes from various companies.

2. Directly Contact Insurance Companies: You can also reach out to insurance companies individually either through their websites or by calling their customer service. Provide them with the necessary details, and they will provide you with a quote.

3. Work with an Independent Insurance Agent: Independent insurance agents have access to multiple insurance providers and can assist you in obtaining quotes from different companies. They can also provide you with expert advice on coverage options and help you choose the best policy.

What is known about car insurance in California?

Car insurance in California is a legal requirement for all drivers. The state follows a tort system, which means that the at-fault driver is responsible for covering the damages resulting from an accident. California also requires drivers to carry minimum liability insurance coverage, which includes:

– $15,000 for injury or death to one person

– $30,000 for injury or death to multiple people

– $5,000 for property damage

It’s important to note that these are only the minimum coverage requirements, and many drivers opt for higher coverage limits to ensure better protection.

Solution: Finding the Best Car Insurance California Quotes

When looking for the best car insurance California quotes, it is crucial to consider several factors:

1. Coverage Options: Assess your insurance needs and determine the coverage options that are important to you, such as comprehensive coverage, collision coverage, or uninsured motorist coverage.

2. Policy Limits: Decide on the appropriate liability coverage limits based on your assets and potential financial risks.

3. Deductibles: Consider the deductible amounts you are comfortable with. A higher deductible can lower your premium but means you’ll have to pay more out of pocket in the event of a claim.

4. Discounts: Inquire about any available discounts that you may qualify for, such as safe driver discounts, multiple policy discounts, or student discounts.

By considering these factors and obtaining quotes from different insurance providers, you can compare coverage options and prices to find the best car insurance policy for your needs.

More Information about Car Insurance California Quotes

Car insurance quotes in California are influenced by various factors:

1. Driving History: Insurance companies consider your driving record when determining the cost of your premium. Drivers with a history of accidents or traffic violations are often considered higher risk and may have higher premiums.

2. Age and Gender: Young and inexperienced drivers, as well as male drivers, often face higher insurance rates due to statistical data suggesting a higher risk of accidents.

3. Location: Where you live in California can impact your car insurance rates. Urban areas with higher traffic volumes and crime rates tend to have higher premiums.

4. Vehicle Type: The make, model, and year of your vehicle can affect insurance rates. Expensive or high-performance cars usually have higher premiums due to higher repair costs or theft risks.

5. Credit History: In many states, including California, insurance companies consider credit history when determining premiums. Maintaining good credit can help lower your car insurance rates.

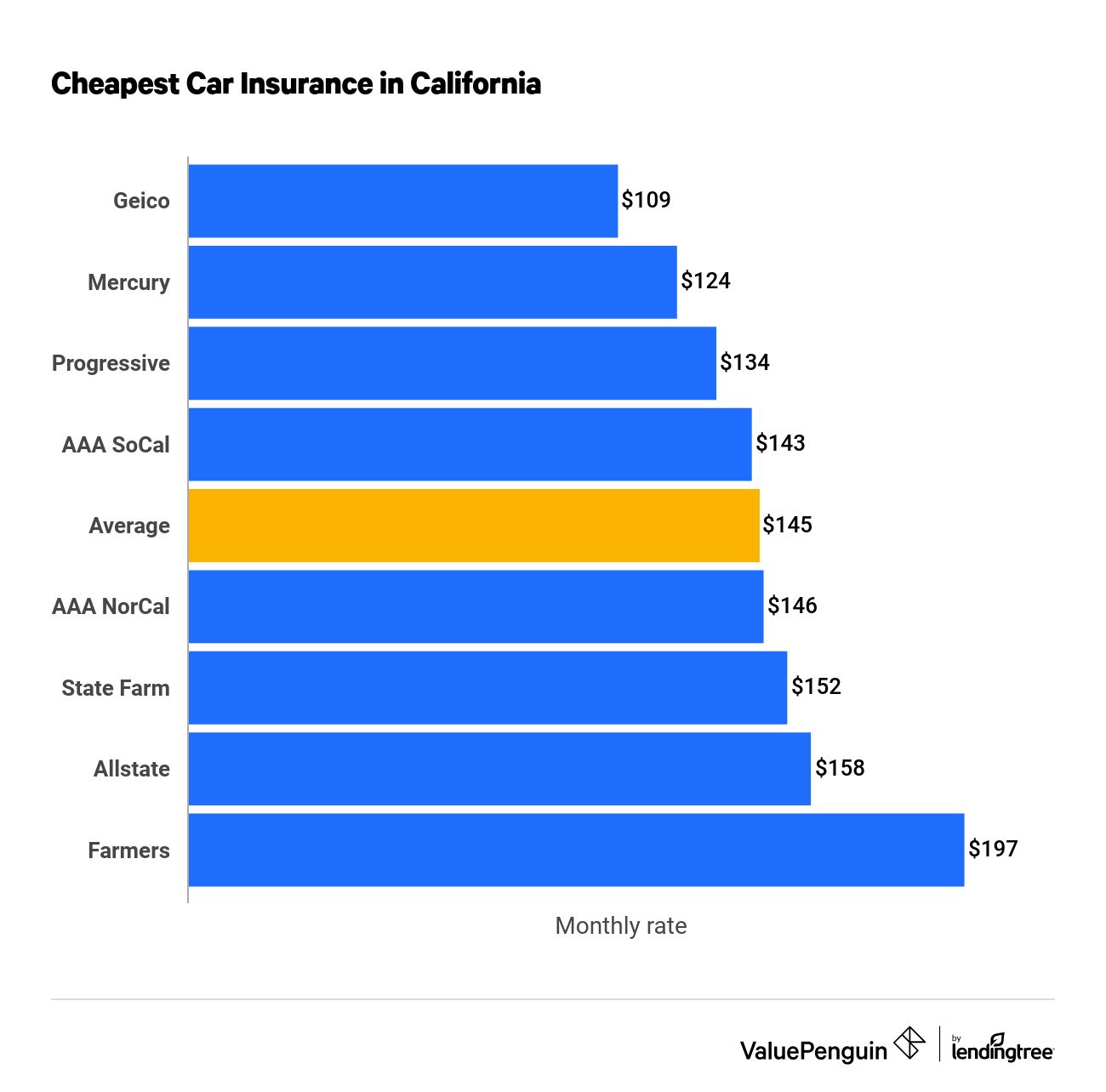

It’s important to note that car insurance rates can vary significantly between providers. Shopping around and obtaining multiple quotes is essential to ensure you get the most competitive rates.

Conclusion

Obtaining car insurance California quotes is essential for any driver in the state. By comparing quotes from different insurance providers, considering coverage options, policy limits, and discounts, you can find the best car insurance policy that meets your needs and budget. Remember to consider factors such as driving history, age, location, vehicle type, and credit history when obtaining quotes. Take the time to research and compare to ensure you get the most suitable coverage at a competitive price.

Frequently Asked Questions (FAQs)

Q1: What are the consequences of driving without car insurance in California?

A1: Driving without car insurance in California can result in fines, license suspension, vehicle impoundment, and potential legal consequences. It is illegal to operate a motor vehicle without proper insurance coverage in the state.

Q2: Can I get car insurance quotes if I have a bad driving record?

A2: Yes, even if you have a bad driving record, you can still obtain car insurance quotes. However, your premiums may be higher compared to drivers with clean records. Shopping around and comparing quotes can help you find the most affordable options.

Q3: Are there any specific discounts available for California drivers?

A3: Yes, California drivers may be eligible for various discounts, such as good driver discounts, multi-vehicle discounts, low-mileage discounts, and vehicle safety feature discounts. It’s important to ask insurance providers about the discounts they offer.

Q4: Can I change my car insurance policy at any time?

A4: Yes, you can change your car insurance policy at any time, even if your policy is still active. However, it’s important to consider any cancellation fees or potential refunds before making any changes.

Q5: How often should I review my car insurance policy and obtain new quotes?

A5: It is recommended to review your car insurance policy and obtain new quotes annually or whenever certain life events occur, such as moving, purchasing a new vehicle, or adding/removing drivers from your policy. Regularly reviewing your policy ensures you have adequate coverage and helps you find potential cost-saving options.