Average Car Insurance in California: Explained and Solutions

Introduction

Car insurance is a crucial aspect of owning a vehicle in California. It provides financial protection in case of accidents or theft. However, understanding the average car insurance rates, factors affecting them, and finding the best coverage can be overwhelming. This article aims to explain what average car insurance in California means, how it is calculated, known factors influencing rates, and solutions for finding affordable coverage.

What do you mean by Average Car Insurance in California?

The average car insurance in California refers to the typical cost of insurance coverage for drivers in the state. It is determined based on various factors such as age, driving history, type of vehicle, location, and coverage levels. Understanding the average insurance rates helps individuals assess their own premiums and make informed decisions when purchasing coverage.

How is Average Car Insurance in California Calculated?

Calculating average car insurance rates in California involves analyzing various factors. Insurance companies rely on statistical data and actuarial tables to assess risk and set premiums. Some common factors considered include:

Age and Gender: Younger drivers and males typically have higher insurance rates due to increased risk.

Driving History: A clean driving record with no accidents or traffic violations usually results in lower premiums.

Type of Vehicle: Expensive or high-performance cars may have higher insurance rates due to higher repair costs.

Location: Areas with higher crime rates or traffic congestion may have higher insurance rates.

Coverage Levels: The more coverage and higher limits you choose, the higher your premiums may be.

Insurance companies analyze these factors along with their own proprietary algorithms to determine the average car insurance rates in California.

Known Factors Influencing Average Car Insurance Rates in California

Several factors significantly influence average car insurance rates in California. These factors can either increase or decrease the premiums individuals pay. Some of the known factors include:

1. Age and Driving Experience

Younger drivers, typically between 16-25 years old, have less driving experience and are statistically more likely to be involved in accidents. Consequently, they are charged higher premiums compared to older, more experienced drivers.

2. Driving Record

Insurance companies closely examine an individual’s driving history, including accidents, tickets, and traffic violations. A clean driving record with no or minimal incidents generally leads to lower insurance rates.

3. Vehicle Type

The type of vehicle you drive affects your insurance rates. High-performance cars, luxury vehicles, or models prone to theft generally have higher insurance premiums due to increased risks and repair costs.

4. Location

Where you live in California also influences your car insurance rates. Urban areas with higher population densities and increased crime rates often have higher premiums compared to rural regions.

5. Coverage and Deductibles

The coverage levels and deductibles you choose impact your insurance rates. Higher coverage limits and lower deductibles result in higher premiums, while opting for minimal coverage and higher deductibles may lower your costs.

6. Credit History

Insurance companies often consider an individual’s credit history as a factor when determining rates. A poor credit score may lead to higher premiums, as it is perceived as an increased risk factor.

Solution: Finding Affordable Car Insurance in California

While car insurance rates in California can be expensive, there are several steps you can take to find affordable coverage. Here are some solutions to consider:

1. Compare Multiple Quotes

Obtain quotes from multiple insurance companies to compare rates and coverage options. Online comparison tools can help simplify this process and save you time.

2. Bundle Insurance Policies

If you have multiple insurance needs, consider bundling them with one company. Many insurers offer discounts for bundling auto, home, or other policies.

3. Maintain a Good Driving Record

Keeping a clean driving record is essential to secure lower insurance rates. Avoid accidents and traffic violations to maintain a good driving history.

4. Opt for Higher Deductibles

Choosing higher deductibles can lower your premiums. However, ensure you can afford to pay the deductible amount in case of an accident or claim.

5. Seek Discounts

Ask insurance providers about available discounts such as good student, safe driver, or low-mileage discounts. These can significantly reduce your premiums.

By implementing these solutions, you can improve your chances of finding affordable car insurance in California.

Conclusion

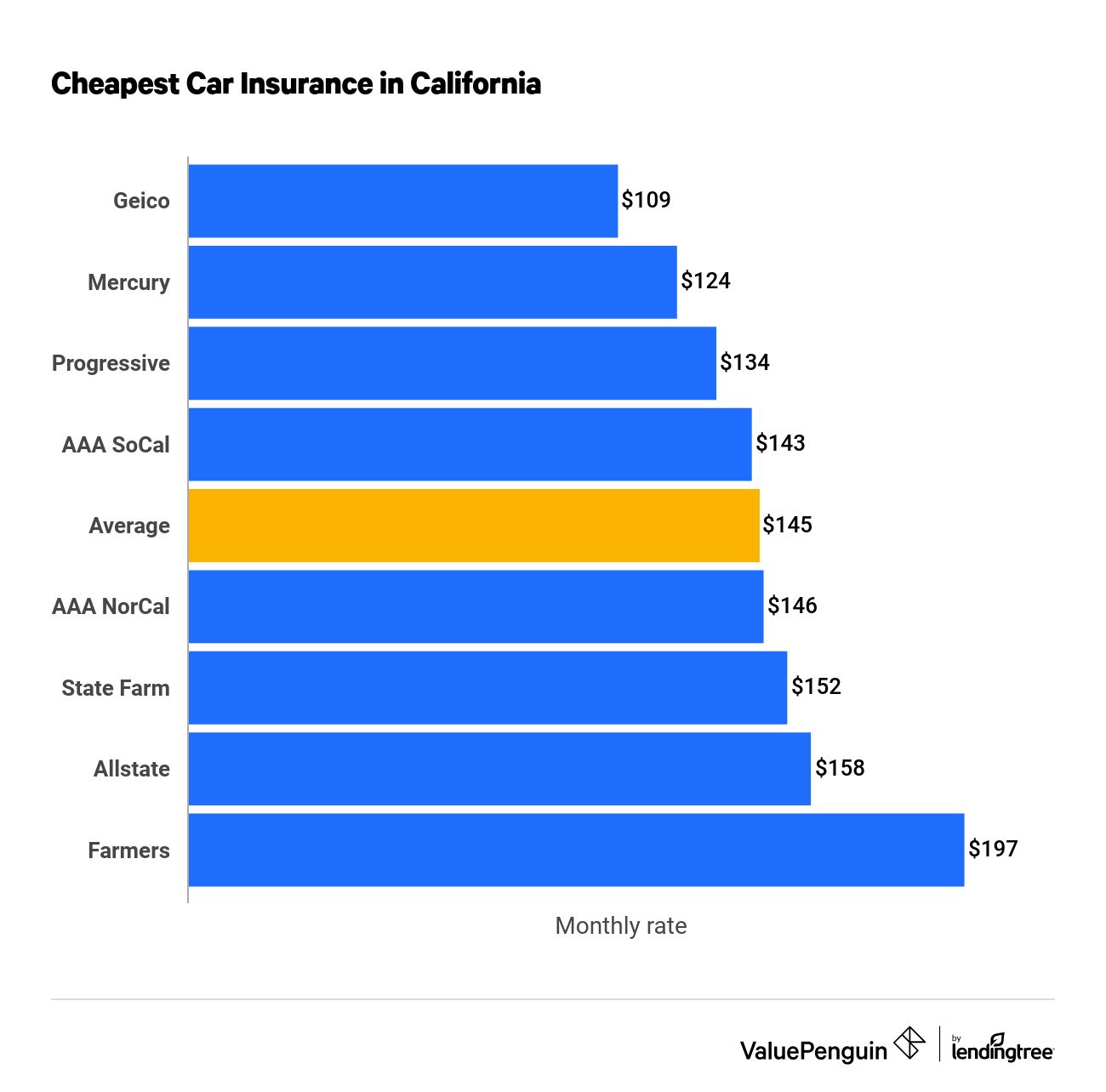

Understanding average car insurance in California is vital for drivers seeking coverage. Factors such as age, driving history, location, and coverage levels significantly influence insurance rates. By comparing quotes, maintaining a clean driving record, and exploring available discounts, individuals can find affordable car insurance in the state. It is essential to assess your needs, budget, and desired coverage to make an informed decision.

FAQs (Frequently Asked Questions)

1. Can I reduce my car insurance rates in California if I have a good credit score?

While a good credit score can positively impact your car insurance rates, it’s not the sole determining factor. Other factors such as driving record, age, and vehicle type also play a significant role in calculating premiums.

2. How often should I compare car insurance quotes in California?

It’s recommended to compare car insurance quotes at least once a year or whenever there are changes in your driving profile or coverage needs. This ensures you are getting the best rates and coverage options available.

3. Are there any specific discounts available for senior drivers in California?

Yes, some insurance companies offer discounts specifically for senior drivers. These discounts may vary, so it’s essential to inquire about them when obtaining quotes or renewing your policy.

4. Can I get car insurance in California if I have a poor driving record?

Yes, even if you have a poor driving record, you can still obtain car insurance in California. However, the rates may be higher due to the increased risk associated with your driving history. Shopping around and comparing quotes from multiple insurers can help find the best rates available.

5. Does California offer any government-sponsored car insurance programs for low-income individuals?

No, California does not offer government-sponsored car insurance programs. However, there are options like the California Low-Cost Auto Insurance Program (CLCA) that provide affordable liability coverage for income-eligible drivers.