Car Insurance Quote California: A Comprehensive Guide

Introduction

Car insurance is a necessity for every driver, providing financial protection against accidents, theft, and damage to your vehicle. When looking for the right car insurance coverage in California, it is essential to obtain a car insurance quote. In this article, we will explain what a car insurance quote is, how to get one, what is known about car insurance quotes in California, and provide you with a solution to find the best quote.

What is a Car Insurance Quote?

A car insurance quote is an estimate of the premium you will pay for your car insurance coverage. It is based on various factors such as your driving history, age, vehicle make and model, and the level of coverage you desire. Insurance companies use complex algorithms to calculate these quotes, taking into account the risk associated with insuring you as a driver.

When obtaining a car insurance quote, you will receive an estimated premium amount, which can help you compare different insurance providers and find the most affordable option for your needs. Keep in mind that the final premium may vary depending on additional factors considered during the underwriting process.

How to Get a Car Insurance Quote in California?

Obtaining a car insurance quote in California is a relatively straightforward process. You can choose to contact insurance companies directly or use online comparison tools to gather multiple quotes simultaneously. Here are the steps to get a car insurance quote:

1. Research and make a list of reputable insurance companies operating in California.

2. Visit the websites of these companies or use online comparison tools.

3. Enter the required information, including personal details, vehicle information, and desired coverage level.

4. Submit the form and wait for the insurance companies to provide you with their quotes.

5. Compare the quotes received, taking into consideration the coverage, deductibles, and any additional benefits offered.

6. Choose the insurance provider that offers the best coverage and premium that fits your budget.

What is Known About Car Insurance Quotes in California?

Car insurance quotes in California are influenced by several factors specific to the state. Firstly, California law requires drivers to have minimum liability coverage, which includes $15,000 for injury/death to one person, $30,000 for injury/death to multiple people, and $5,000 for property damage.

Secondly, insurance companies consider California’s high population density, traffic congestion, and the likelihood of accidents when calculating premiums. Areas with higher accident rates or vehicle theft rates may result in higher insurance quotes.

In addition, your personal driving record, credit score, age, and gender can impact the quotes you receive. Insurance providers in California also consider the make and model of your vehicle, your annual mileage, and the purpose of your vehicle usage, such as commuting or pleasure.

The Solution: Finding the Best Car Insurance Quote in California

With numerous insurance providers and policies available, finding the best car insurance quote in California can be overwhelming. However, there is a solution to simplify your search and ensure you make an informed decision.

By utilizing online comparison tools, you can save time and effort by receiving multiple quotes from different insurance companies in one place. These tools allow you to enter your information once and receive customized quotes tailored to your needs.

Furthermore, these comparison tools often provide additional features such as customer reviews, ratings, and the option to directly contact insurance agents for further clarification. This comprehensive approach empowers you to choose the best car insurance quote that offers optimal coverage and fits your budget.

Conclusion

When looking for a car insurance quote in California, it is crucial to understand what it means, how to obtain one, and what factors influence the quotes. By utilizing online comparison tools, you can simplify your search and find the best car insurance quote that meets your coverage needs and budget. Remember to consider factors such as coverage levels, deductibles, and additional benefits when making your decision. Don’t hesitate to explore different options before settling on the one that suits you best.

Frequently Asked Questions (FAQs)

1. Can I get a car insurance quote without providing personal information?

No, car insurance quotes require personal information to accurately calculate premiums based on individual risk factors. However, ensure you are providing your information on secure websites to protect your privacy.

2. Are car insurance quotes in California higher compared to other states?

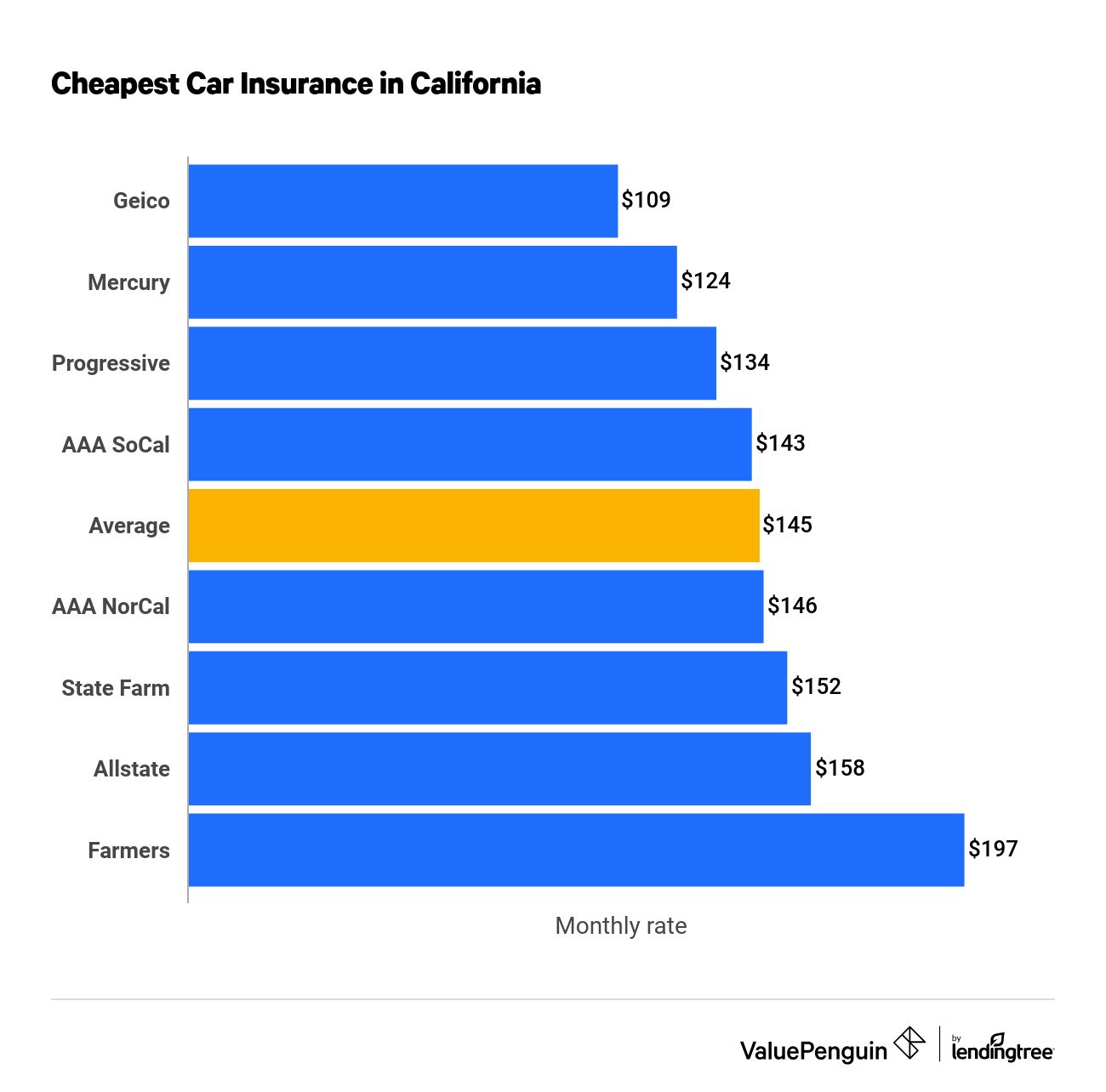

Car insurance quotes in California can be higher due to factors such as population density, traffic congestion, and higher accident rates. However, it is important to compare quotes from different insurance providers to find the most competitive rates.

3. Can my car insurance quote change after I purchase the policy?

Yes, car insurance quotes are estimates based on the information provided at the time of the quote. The final premium may change after the insurance company reviews additional factors during the underwriting process.

4. What happens if I don’t have car insurance in California?

Driving without car insurance in California is illegal and can result in penalties such as fines, license suspension, and vehicle impoundment. It is essential to have at least the minimum required liability coverage in the state.

5. Can I negotiate the car insurance quote with the insurance company?

While insurance companies have set algorithms to calculate quotes, you can discuss your options with them to find potential discounts or additional benefits that can lower your premium. It’s always worth asking about available discounts or packages that may apply to your situation.