Lemonade Car Insurance in California: A Refreshing Choice for Auto Coverage

When it comes to car insurance in California, Lemonade offers a refreshing alternative that is gaining popularity amongst drivers across the state. Lemonade, a tech-driven insurance company, has disrupted the traditional insurance industry with its innovative approach, streamlined processes, and commitment to providing affordable and hassle-free coverage. In this article, we will explore what Lemonade car insurance is all about, how it works, what sets it apart, and why it might be the solution you’ve been looking for.

What is Lemonade Car Insurance?

Lemonade car insurance is a type of auto coverage offered by Lemonade, an insurance company that operates mainly online. Founded in 2015, Lemonade has quickly made a name for itself by leveraging technology and artificial intelligence to simplify insurance processes. Their car insurance policies aim to provide comprehensive coverage at competitive rates, all while offering a user-friendly experience that sets them apart from traditional insurers.

How Does Lemonade Car Insurance Work?

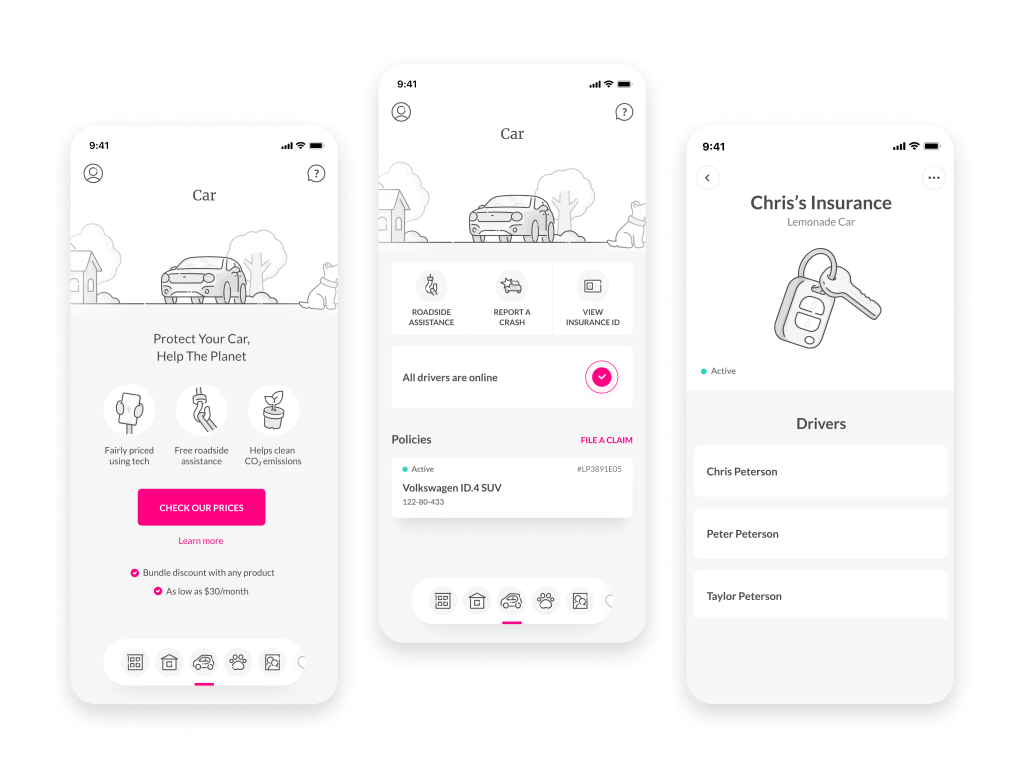

Getting car insurance with Lemonade is as easy as it gets. By visiting their website or using their mobile app, you can get a quote and purchase a policy in a matter of minutes. Lemonade has simplified the entire process, making it quick and convenient to get the coverage you need.

One of the standout features of Lemonade car insurance is their claims process. When you file a claim, Lemonade utilizes artificial intelligence algorithms to assess and process your claim faster than ever before. In fact, they boast about their ability to handle claims in a matter of seconds, thanks to their advanced technology.

What Sets Lemonade Car Insurance Apart?

There are several unique features that set Lemonade car insurance apart from its competitors. Firstly, Lemonade operates as a B-Corp, which means they have a legal obligation to act in the best interests of their policyholders. This commitment to transparency and ethical practices is a breath of fresh air in the insurance industry.

Secondly, Lemonade takes a flat fee out of your premium to cover their expenses, while the rest of the money goes towards paying claims. This means they have no incentive to deny or delay claims, as any money left over at the end of the year is donated to charitable causes selected by their policyholders. This unique business model creates a sense of trust and alignment of interests between Lemonade and its customers.

Another aspect that makes Lemonade stand out is their focus on incorporating technology into every aspect of their business. From the user-friendly website and app to the AI-powered claims process, Lemonade embraces innovation to enhance the customer experience and simplify insurance.

The Solution for Affordable and Hassle-Free Coverage

For California drivers looking for affordable and hassle-free car insurance, Lemonade offers a compelling solution. By leveraging technology, transparency, and a customer-centric approach, Lemonade has revolutionized the insurance industry and created a unique offering that resonates with its policyholders.

With Lemonade, you can expect competitive rates, a quick and easy online purchasing process, and a claims experience that is faster than ever before. Whether you are a seasoned driver or a new car owner, Lemonade provides the peace of mind that comes with comprehensive coverage without the headaches associated with traditional insurers.

Frequently Asked Questions (FAQs)

1. Is Lemonade car insurance available in all states?

No, Lemonade car insurance is currently available in select states, including California. However, they are continuously expanding their coverage areas, so it’s worth checking if they operate in your state.

2. Does Lemonade offer any discounts on car insurance?

Yes, Lemonade offers various discounts on car insurance, such as bundling multiple policies, having a good driving record, and opting for higher deductibles. These discounts can help you save on your premiums.

3. How does Lemonade handle claims so quickly?

Lemonade utilizes artificial intelligence algorithms to automate and expedite their claims process. This allows them to assess and process claims in a matter of seconds, providing a faster and more efficient experience for policyholders.

4. Can I customize my Lemonade car insurance policy?

Yes, Lemonade allows you to customize your car insurance policy to suit your needs. You can adjust coverage limits, add optional coverages, and choose deductibles that align with your budget and risk tolerance.

5. Is Lemonade car insurance more expensive than traditional insurance?

Lemonade car insurance is known for its competitive rates. While prices may vary depending on factors such as your driving history and the type of vehicle you own, Lemonade strives to provide affordable coverage without compromising on quality or customer experience.