Rental Car Insurance in California: What You Need to Know

What do you mean by Rental Car Insurance?

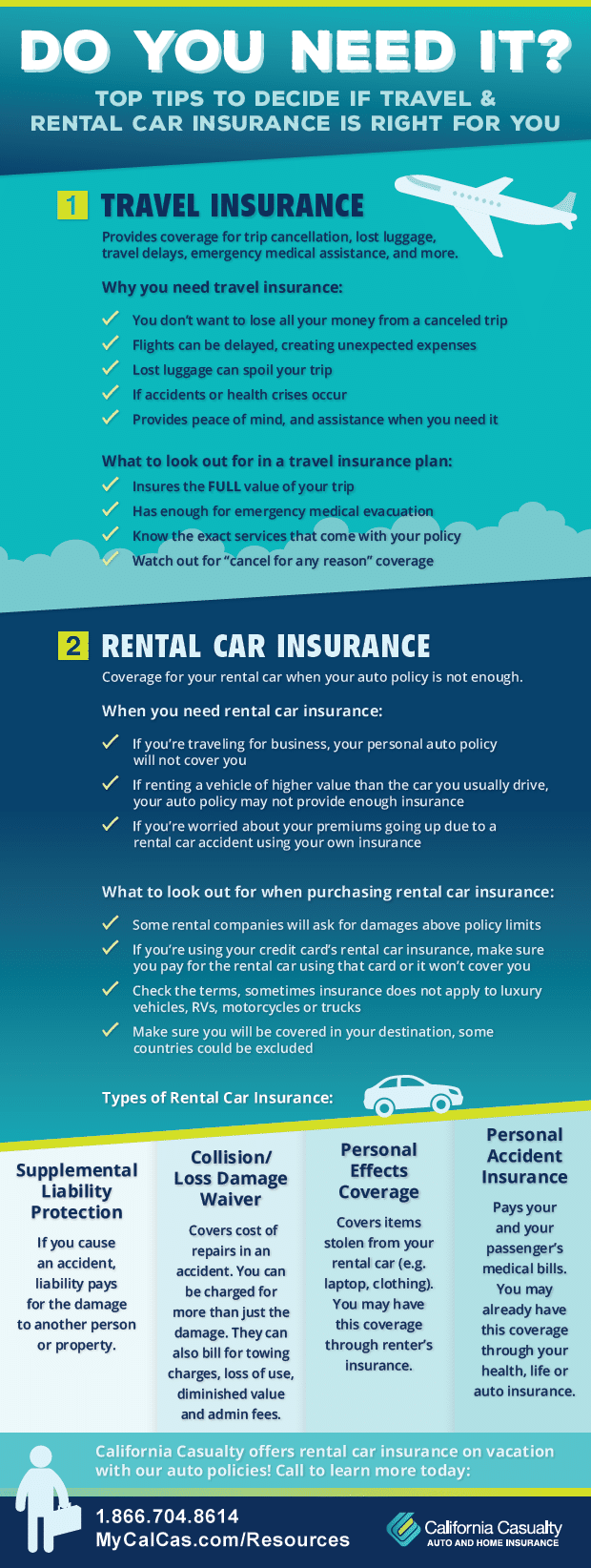

Rental car insurance is a type of coverage that provides protection for individuals who rent vehicles. It is designed to cover the costs associated with damages or losses that may occur during the rental period. This insurance can be purchased from the rental car company or through a third-party provider.

How does Rental Car Insurance work in California?

In California, rental car insurance works by providing coverage for damages or losses to the rented vehicle. This can include accidents, theft, vandalism, and other incidents that may occur during the rental period. When you rent a car in California, the rental company will offer you various insurance options, including collision damage waiver (CDW), liability insurance, personal accident insurance, and personal effects coverage.

What is known about Rental Car Insurance in California?

When renting a car in California, it is important to understand what rental car insurance options are available and what they cover. The rental company will typically offer a collision damage waiver (CDW), which relieves you of financial responsibility if the rental car is damaged or stolen. However, this coverage may come with a high deductible.

Additionally, liability insurance is required by law in California, and rental car companies are required to include minimum liability coverage in their rental rates. This insurance protects you if you cause an accident and damage property or injure someone. However, the minimum coverage may not be sufficient, and you may want to consider purchasing additional liability coverage.

Personal accident insurance, on the other hand, provides coverage for medical expenses resulting from an accident while driving the rental car. It may also include accidental death and dismemberment benefits. Personal effects coverage protects your personal belongings that are stolen or damaged while in the rental car.

Solution for Rental Car Insurance in California

If you already have auto insurance, check with your insurance provider to see if rental cars are covered under your policy. Many auto insurance policies include coverage for rental cars, eliminating the need for additional insurance. However, it is important to review your policy limits and deductibles to ensure they meet your needs.

If your auto insurance does not cover rental cars or if you do not have auto insurance, you have the option to purchase rental car insurance from the rental company. Carefully consider the coverage options and costs, as rental car insurance can be expensive. Compare the rates and coverage offered by different rental car companies to find the best option for your needs.

Important Information about Rental Car Insurance in California

Before renting a car in California, it is essential to understand the following key points about rental car insurance:

Minimum liability insurance is required by law in California.

Rental car companies must include minimum liability coverage in their rental rates.

Collision damage waiver (CDW) may be offered by the rental company to relieve you of financial responsibility for damages or theft.

Personal accident insurance provides coverage for medical expenses resulting from an accident while driving the rental car.

Personal effects coverage protects your belongings if they are stolen or damaged while in the rental car.

Review your existing auto insurance policy to see if rental cars are already covered.

Compare rates and coverage options offered by different rental car companies to find the best deal.

Conclusion

Rental car insurance in California is an important consideration when renting a vehicle. Understanding the different coverage options available and knowing what is required by law can help you make an informed decision. Whether you choose to rely on your existing auto insurance or purchase rental car insurance from the rental company, make sure you have adequate coverage to protect yourself and your finances.

Frequently Asked Questions (FAQs)

1. Is rental car insurance mandatory in California?

No, rental car insurance is not mandatory in California. However, minimum liability insurance is required by law, and rental car companies must include this coverage in their rental rates.

2. Will my existing auto insurance policy cover rental cars in California?

It depends on your policy. Some auto insurance policies include coverage for rental cars, but it is important to review your policy limits and deductibles to ensure they meet your needs.

3. What does collision damage waiver (CDW) cover?

A collision damage waiver (CDW) offered by the rental company relieves you of financial responsibility if the rental car is damaged or stolen. However, it may come with a high deductible.

4. Can I purchase rental car insurance from a third-party provider?

Yes, you can purchase rental car insurance from third-party providers. It is recommended to compare the rates and coverage offered by different providers to find the best option for your needs.

5. What should I do if I have an accident in a rental car in California?

If you have an accident in a rental car in California, follow the same steps you would in any other accident. Contact the rental car company, report the incident to the police, and notify your insurance provider if necessary.