Cheap Car Insurance California Online

Car insurance is a necessary expense for vehicle owners in California, but that doesn’t mean it has to break the bank. With the advent of online platforms, finding cheap car insurance in California has become easier than ever before. In this article, we will explore what cheap car insurance in California means, how to find it, what is currently known about the topic, and potential solutions for obtaining affordable coverage. Whether you are a new driver or a seasoned one, this information will help you make informed decisions about your car insurance needs.

What do we mean by cheap car insurance in California?

When we refer to cheap car insurance in California, we are talking about finding coverage that offers adequate protection at an affordable price. While the cost of car insurance can vary depending on factors such as your driving record, age, and the type of vehicle you own, there are strategies you can employ to ensure you are getting the best possible rates.

How can you find cheap car insurance in California?

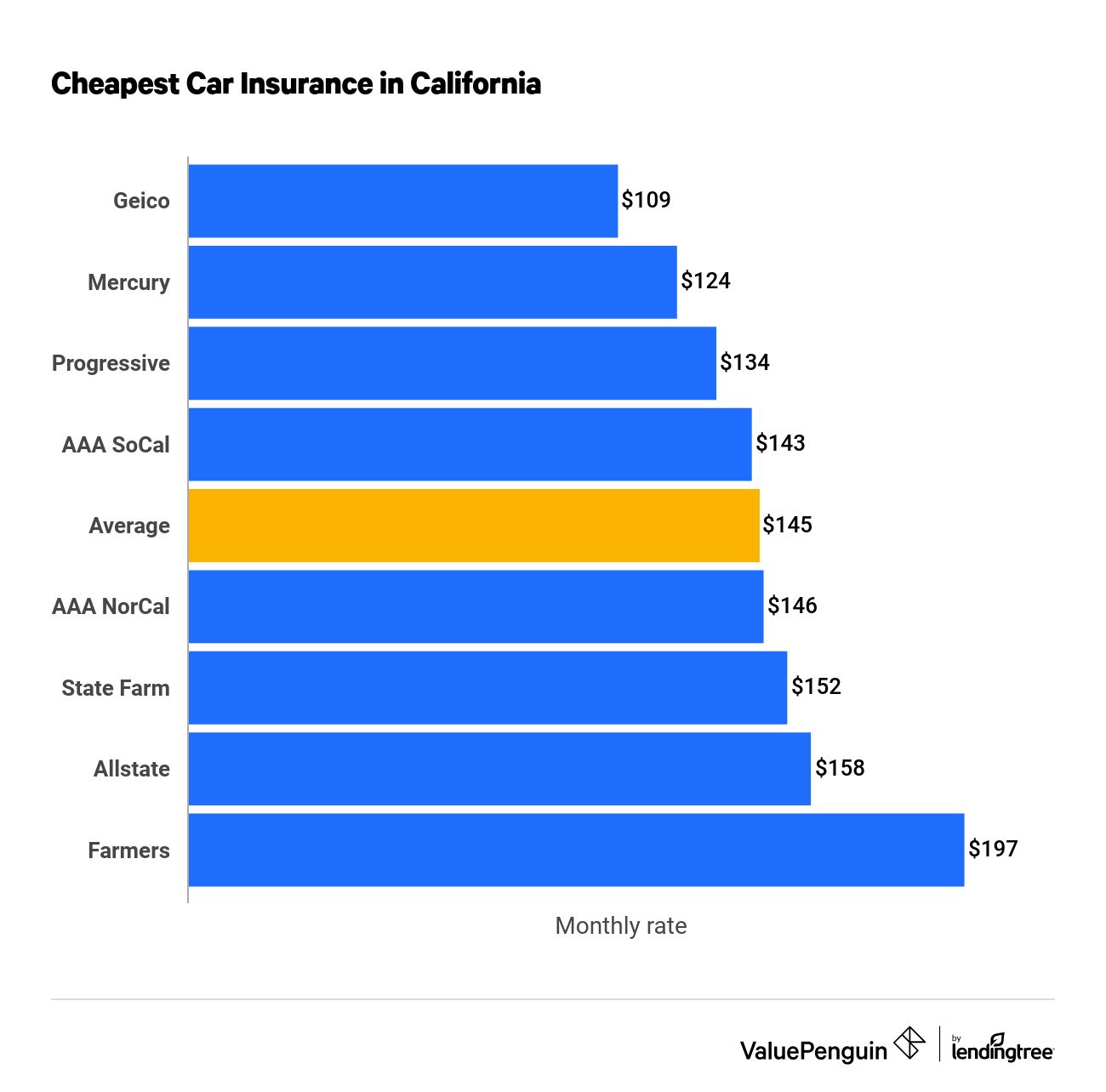

Thanks to the internet, finding cheap car insurance in California has never been easier. Online platforms allow you to compare rates from various insurance providers, making it simple to find the most affordable options. By entering your information once, you can receive quotes from multiple companies, saving you time and effort in your search for the best rates.

Additionally, taking advantage of discounts can help further reduce your car insurance premiums. Many insurance providers offer discounts for safe driving records, bundling multiple policies, and completing defensive driving courses. It’s essential to inquire about these discounts when obtaining quotes so that you can take advantage of every opportunity to save.

What is currently known about cheap car insurance in California?

Studies have shown that the cost of car insurance in California can vary significantly depending on various factors. For instance, urban areas tend to have higher insurance rates compared to rural areas due to factors like higher traffic congestion and increased likelihood of accidents. Additionally, factors such as a driver’s age, gender, and marital status can also impact insurance rates.

Furthermore, the type of vehicle you drive can significantly influence your insurance premiums. Expensive cars with high repair costs and those with higher theft rates typically have higher insurance rates. On the other hand, vehicles equipped with advanced safety features and those with good crash test ratings may be eligible for discounts.

What are the potential solutions for obtaining cheap car insurance in California?

One potential solution for obtaining cheap car insurance in California is to carefully consider the coverage options you need. While it’s important to have adequate coverage to protect yourself and your vehicle, opting for unnecessary add-ons can increase your premiums. Evaluating your insurance needs and choosing coverage options that best suit your circumstances can help keep your rates lower.

Another solution is to maintain a clean driving record. Insurance providers typically offer better rates to drivers with no accidents or traffic violations. By obeying traffic laws and driving safely, you can position yourself as a lower-risk driver and potentially enjoy cheaper insurance rates.

Conclusion

Finding cheap car insurance in California is not an impossible task thanks to online platforms that make comparing rates effortless. By utilizing these platforms and exploring potential discounts, you can save money on your car insurance premiums. Remember to consider factors such as your driving record, the type of vehicle you own, and the coverage options you need to find the best balance between affordability and adequate protection.

FAQs

1. Can I get cheap car insurance in California if I have a poor driving record?

While a poor driving record can increase your insurance rates, there are still opportunities to find relatively cheaper options. It’s crucial to shop around, compare quotes, and inquire about discounts that may offset the impact of a less-than-perfect driving history.

2. Are online car insurance quotes accurate?

Online car insurance quotes are typically accurate if you provide accurate information. However, it’s important to remember that these quotes are estimates based on the information provided and may vary slightly when you finalize your policy.

3. Are there any government programs in California to help lower car insurance costs?

Currently, there are no government programs specifically aimed at lowering car insurance costs in California. However, it’s always a good idea to stay informed about any potential changes in legislation that may affect insurance rates.

4. Should I opt for the minimum coverage required by law to save money?

While opting for the minimum coverage required by law may save you money in the short term, it’s essential to consider the potential financial risks associated with inadequate coverage. Evaluate your own circumstances and the value of your vehicle to determine the appropriate level of coverage for your needs.

5. Can I switch car insurance providers if I find a cheaper option?

Yes, you can switch car insurance providers if you find a cheaper option. Just make sure to review the terms and conditions of your current policy and any potential penalties for early cancellation before making the switch.