Car Insurance California: Everything You Need to Know

Introduction

Car insurance is a crucial aspect of owning and operating a vehicle, and it is no different in the beautiful state of California. In this comprehensive guide, we will delve into the intricacies of car insurance in California, exploring what it means, how it works, what is known about it, and potential solutions to common issues. So, whether you are a new driver or a seasoned one, buckle up and let’s hit the road to understand the ins and outs of car insurance in California.

What do you mean by Car Insurance California?

Car insurance is a contract between an individual and an insurance company that provides financial protection in the event of an accident, theft, or damage to the vehicle. In the state of California, car insurance is mandatory for all drivers and vehicle owners. It ensures that motorists are financially responsible for any harm caused to others or their property due to a car accident.

How does Car Insurance in California Work?

Car insurance in California operates on a system known as the tort system. Under this system, if you are found at fault in an accident, you are liable for the damages and injuries suffered by others involved. To comply with California law, drivers must carry liability insurance that meets the state’s minimum coverage requirements.

California requires drivers to have liability insurance with the following minimum coverage limits:

$15,000 for injury/death to one person

$30,000 for injury/death to multiple people

$5,000 for property damage

These minimum coverage limits ensure that drivers have the necessary financial means to compensate others in case of an accident.

What is Known about Car Insurance California?

Car insurance rates in California can vary based on several factors. Some of the key factors that influence car insurance rates in California include:

Age and gender

Driving history and record

Location and address

Type of vehicle

Coverage options and deductibles

It is important to note that California law prohibits insurance companies from using certain factors, such as credit scores and marital status, to determine car insurance rates. However, insurers can consider factors like ZIP code and mileage driven.

Solution: Finding the Right Car Insurance in California

Finding the right car insurance in California can seem like navigating a maze. However, with the following steps, you can simplify the process and ensure you have adequate coverage:

1. Assess Your Coverage Needs

Start by evaluating your coverage needs, considering factors such as your driving habits, financial situation, and the value of your vehicle. This will help you determine the appropriate coverage types and limits.

2. Shop Around and Compare Quotes

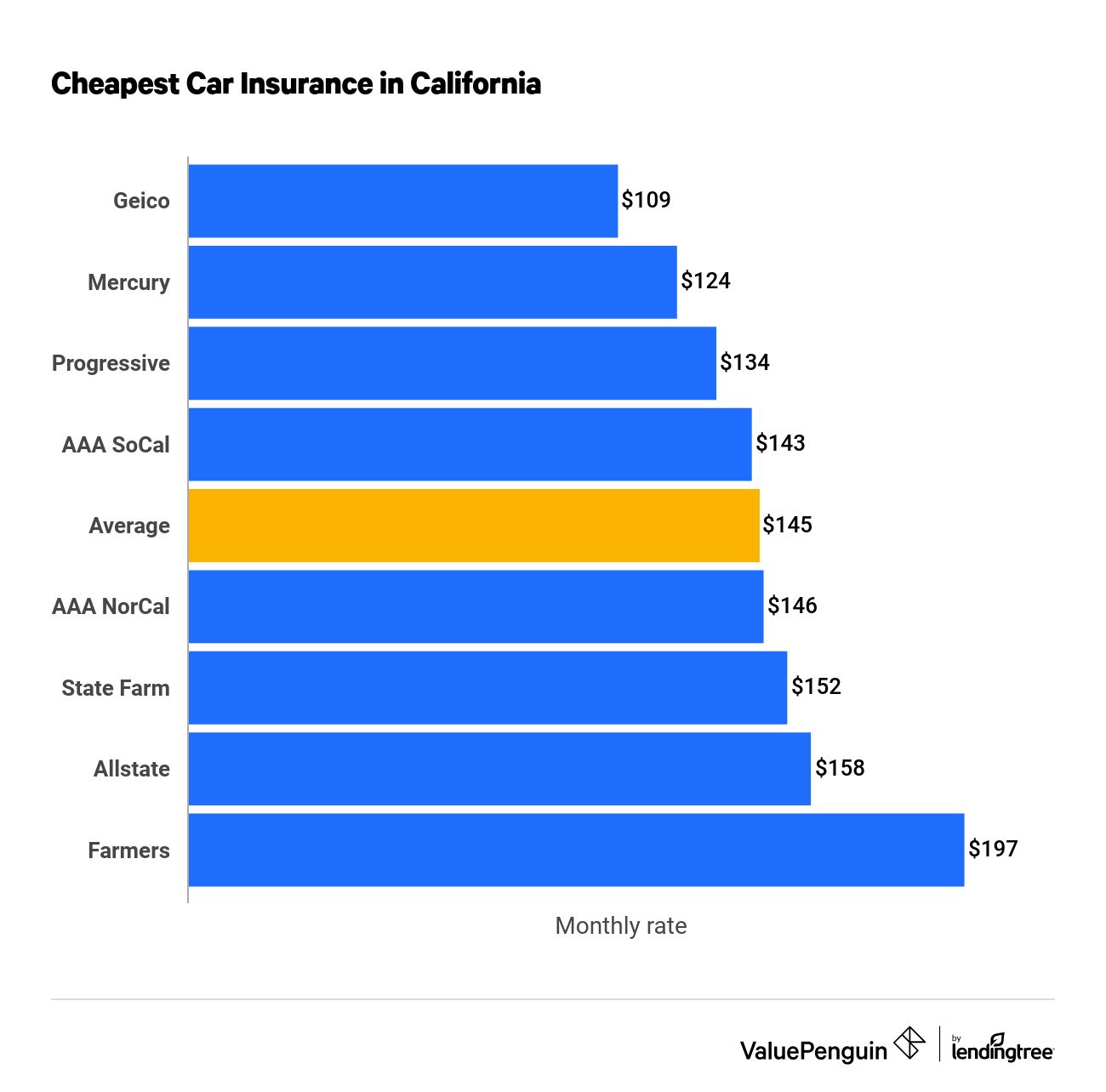

Insurance rates can vary significantly between companies. Take the time to shop around and obtain quotes from multiple insurance providers. This will help you find the best coverage at the most competitive price.

3. Look for Discounts

Many insurance companies offer discounts that can help lower your premium. Common discounts include safe driver discounts, multi-policy discounts, and discounts for installing safety features in your vehicle. Be sure to inquire about any available discounts.

4. Review the Insurance Company’s Reputation

Before finalizing your decision, research the insurance company’s reputation. Look for customer reviews, ratings, and complaints to ensure you select a reliable and trustworthy insurer.

5. Review and Understand the Policy

Once you have selected an insurance provider, carefully review the policy terms and conditions. Make sure you understand the coverage, deductibles, exclusions, and any additional features or riders included in the policy.

Conclusion

Car insurance in California is a mandatory requirement to ensure financial protection for drivers and others involved in accidents. By understanding the basics of car insurance in California, including its meaning, how it works, and available solutions, you can make informed decisions to obtain the most suitable coverage. Remember to assess your coverage needs, shop around for quotes, and select a reputable insurance company that meets your requirements. Drive safely, stay insured, and enjoy the open roads of California!

Frequently Asked Questions (FAQs)

1. What happens if I drive without car insurance in California?

Driving without car insurance in California is illegal and can result in penalties, fines, and even suspension of your driver’s license. It is essential to maintain the state’s required minimum liability coverage at all times.

2. Are there any additional optional coverages I should consider?

While liability insurance is mandatory, you may also consider additional optional coverages such as collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. These can provide extra protection and peace of mind.

3. Can I use my out-of-state car insurance in California?

If you are moving to California from another state, you will typically need to obtain car insurance that complies with California’s minimum coverage requirements. Your out-of-state insurance may not provide adequate coverage or meet California’s regulations.

4. How can I lower my car insurance rates in California?

To lower your car insurance rates in California, you can consider options such as maintaining a clean driving record, bundling multiple insurance policies with the same provider, increasing deductibles, and taking advantage of available discounts.

5. Can I cancel my car insurance policy at any time?

Yes, you can cancel your car insurance policy at any time. However, it is important to ensure you have alternative coverage in place before canceling to avoid any lapses in insurance coverage, which can lead to legal and financial consequences.