Temporary Car Insurance California: Everything You Need to Know

What is Temporary Car Insurance?

Temporary car insurance, also known as short-term car insurance, is a type of auto insurance policy that provides coverage for a specific period. Unlike traditional car insurance policies, which typically last for six or twelve months, temporary car insurance policies can be tailored to your specific needs, ranging from a single day to a few weeks or months.

This type of insurance is particularly useful in situations where you don’t need year-round coverage, such as borrowing a friend’s car, renting a car for a vacation, or test-driving a vehicle before making a purchase.

How to Get Temporary Car Insurance in California?

If you’re looking to get temporary car insurance in California, the process is relatively straightforward. You can start by researching insurance providers that offer this type of coverage. Many major insurance companies and online insurance brokers provide temporary car insurance options. Compare different policies, coverage limits, and prices to find the best option for your needs.

Once you’ve chosen an insurance provider, you’ll need to provide some basic information about yourself and the vehicle you intend to insure. This may include your driver’s license number, vehicle identification number (VIN), and details about your driving history. The insurance company will then calculate your premium based on these factors and the duration of coverage you require.

What is Known About Temporary Car Insurance in California?

In California, temporary car insurance is regulated by the state’s Department of Insurance, ensuring that consumers are protected and have access to reliable coverage. The minimum coverage requirements for temporary car insurance in California are the same as those for traditional auto insurance policies.

Temporary car insurance in California provides liability coverage, which pays for damages you cause to others in an accident. This coverage helps protect you from potentially significant financial loss if you’re found at fault in an accident.

Additionally, some temporary car insurance policies may include comprehensive and collision coverage, which provide protection for damages to your own vehicle. However, these coverages are typically optional and may increase your premium.

Solution for Temporary Car Insurance in California

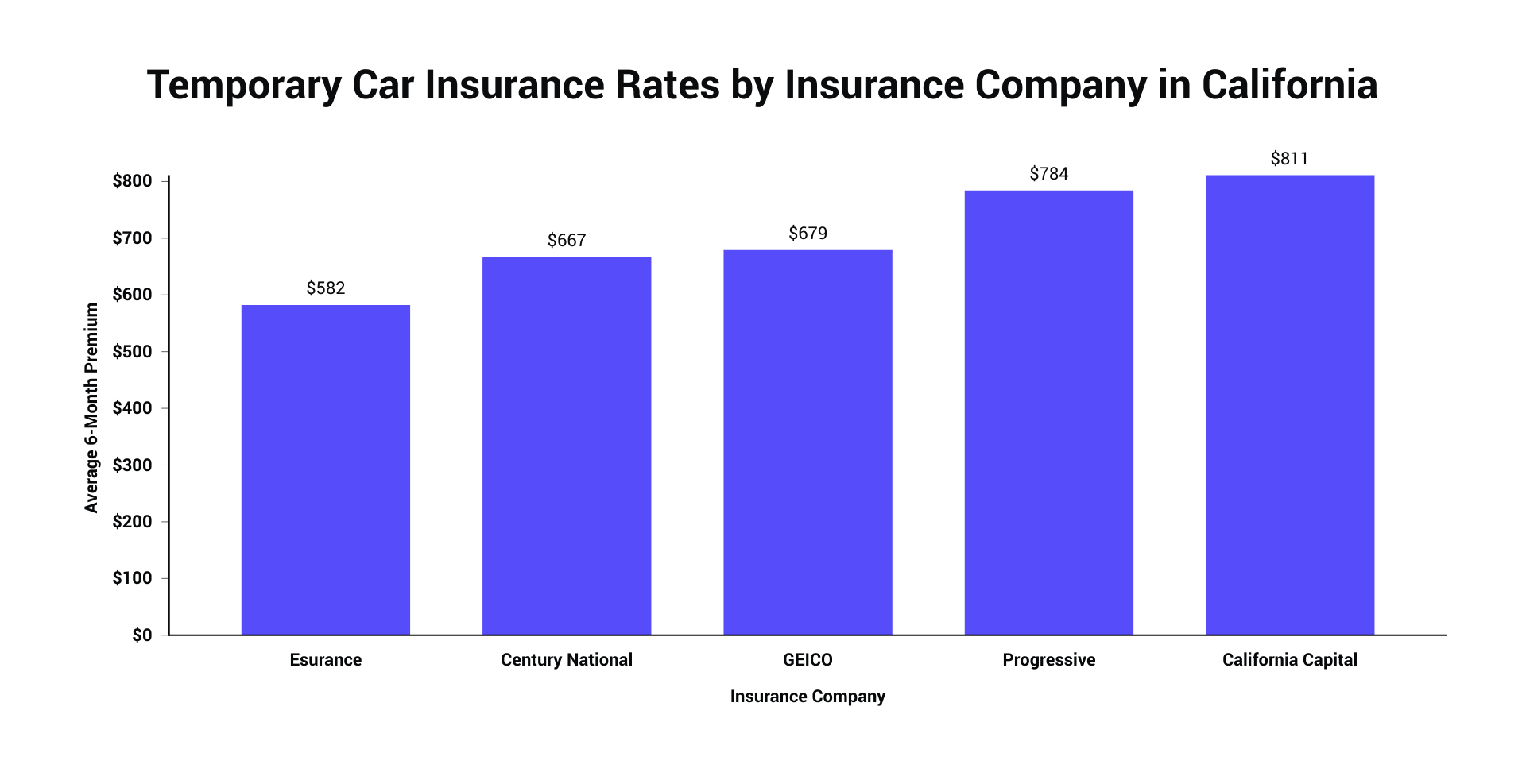

There are several insurance providers in California that offer temporary car insurance policies, catering to the unique needs of drivers who require short-term coverage. Some popular options include GEICO, Progressive, and State Farm. These companies offer convenient online quote tools, allowing you to compare prices and coverage options from the comfort of your own home.

When selecting a temporary car insurance policy in California, it’s important to consider your specific needs and budget. Carefully review the terms and conditions, coverage limits, deductibles, and any additional features or benefits offered by each insurance provider.

By taking the time to research and compare different temporary car insurance options, you can ensure that you find the best policy for your needs, providing you with peace of mind while you’re on the road.

Additional Information about Temporary Car Insurance in California

Temporary car insurance policies in California typically have certain restrictions and limitations. It’s essential to understand these factors before purchasing a policy:

1. Coverage Period: Temporary car insurance policies have specific start and end dates. Make sure you choose the appropriate coverage duration that aligns with your needs.

2. Eligibility Requirements: Insurance providers may have specific eligibility criteria, such as age restrictions or a minimum driving experience requirement. Ensure you meet these requirements before applying for temporary car insurance.

3. Usage Limitations: Some temporary car insurance policies in California may have restrictions on the purpose and usage of the insured vehicle. Make sure you understand any limitations, such as personal use only or excluding business use.

4. Availability of Add-Ons: Certain insurance providers may offer optional add-ons to enhance your coverage, such as roadside assistance or rental car reimbursement. Consider these additional features if they align with your needs.

5. Cancellation Policy: Understand the terms and conditions of canceling your temporary car insurance policy. Some providers may allow refunds for unused days, while others may have specific cancellation fees.

Conclusion

Temporary car insurance in California provides a flexible and convenient solution for individuals who require short-term coverage. By understanding the basics of temporary car insurance, researching different providers, and considering your specific needs, you can find the right policy at the best price.