How Much Does Car Insurance Cost in California?

Introduction

Car insurance is a necessity for all drivers in California. It provides financial protection in case of accidents, theft, or other incidents that may damage your vehicle. However, the cost of car insurance can vary significantly depending on various factors. In this article, we will explore what influences car insurance rates in California and provide you with insights on how much car insurance typically costs in the Golden State.

Factors that Influence Car Insurance Rates

Several factors are considered when determining car insurance rates in California. Insurance companies use these factors to assess the risk associated with insuring a driver. The following are some key elements that impact the cost of car insurance:

1. Age and Gender: Younger drivers, typically those under 25 years old, and male drivers tend to have higher insurance rates due to their higher risk of accidents.

2. Driving Experience: Drivers with more years of experience are often eligible for lower insurance rates as they are considered to be more skilled and less likely to be involved in accidents.

3. Location: The area where you reside or park your vehicle plays a significant role in determining your car insurance rates. Urban areas with higher crime rates or a high number of accidents are usually associated with higher premiums.

4. Vehicle Type: The make, model, and age of your vehicle can affect your insurance costs. Expensive or high-performance cars are generally more expensive to insure due to their higher repair costs or increased risk of theft.

5. Driving Record: Your driving history, including any past accidents or traffic violations, is a crucial factor in determining your insurance rates. Drivers with a clean record usually benefit from lower premiums.

Typical Car Insurance Costs in California

While car insurance costs vary from person to person, it’s essential to understand the average premiums in California. According to the California Department of Insurance, the average annual car insurance premium in the state is around $1,800. However, this figure can significantly differ based on individual circumstances.

The minimum liability coverage required by the state is $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage. The average cost for this minimum coverage is approximately $574 per year.

If you opt for additional coverage, such as comprehensive and collision coverage, the cost will increase. Comprehensive coverage protects your vehicle against theft, vandalism, or damages unrelated to accidents, while collision coverage covers damages resulting from accidents.

Adding these coverages to your policy can increase your annual premium to an average of $1,230. However, it’s important to note that these figures are just averages, and your actual costs may differ based on the factors mentioned earlier.

Ways to Save on Car Insurance in California

Although car insurance costs in California can be significant, there are several ways to save money without compromising your coverage. Here are some tips to help you reduce your car insurance expenses:

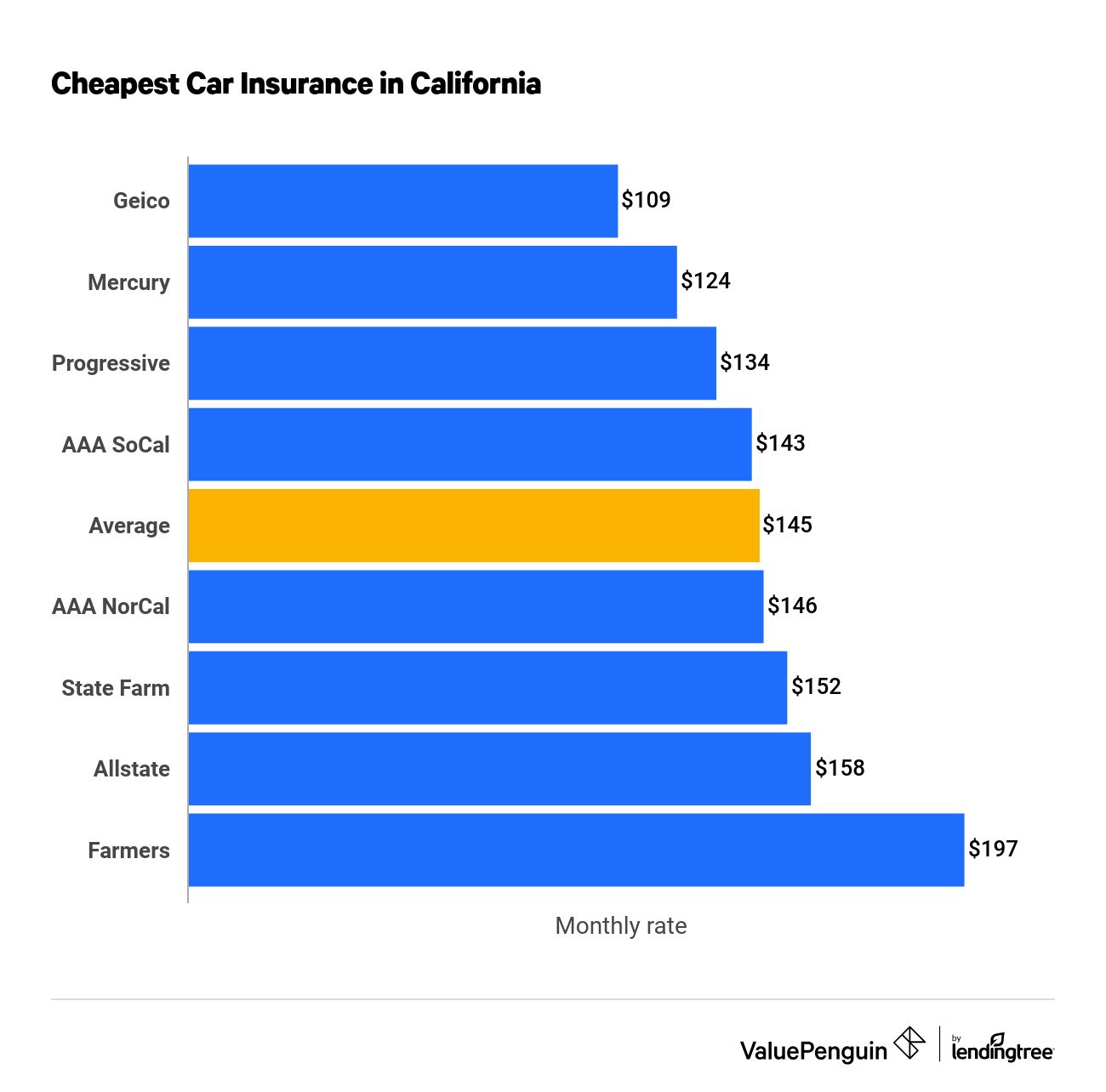

1. Shop Around: Obtain quotes from multiple insurance companies to compare prices and coverage options. Each insurer has its own rating system, so rates can vary significantly.

2. Increase Deductibles: Opting for a higher deductible can lower your premium. However, ensure you can afford the deductible in case of an accident.

3. Bundle Policies: If you have multiple insurance needs, such as home or renter’s insurance, consider bundling them with the same insurer to qualify for multi-policy discounts.

4. Maintain a Good Credit Score: Insurance companies often consider credit history when determining rates. Maintaining a good credit score can help you secure lower premiums.

5. Take Advantage of Discounts: Inquire about available discounts, such as safe driver discounts, good student discounts, or discounts for installing safety features in your vehicle.

Conclusion

Car insurance costs in California can vary significantly based on several factors, including age, gender, driving record, location, and vehicle type. Understanding these factors and comparing quotes from different insurance companies can help you find the most affordable coverage that meets your needs. By implementing money-saving strategies and taking advantage of available discounts, you can keep your car insurance costs as low as possible while still enjoying adequate protection on the road.

Frequently Asked Questions (FAQs)

1. Can I drive in California without car insurance?

No, it is illegal to drive in California without car insurance. You must have at least the minimum liability coverage required by the state.

2. Are there any special car insurance requirements in California?

Yes, California law requires drivers to have liability insurance coverage and provide proof of insurance when registering a vehicle or requested by law enforcement.

3. How can I find the best car insurance rates in California?

Shopping around and obtaining quotes from multiple insurance companies is the best way to find the most affordable car insurance rates in California.

4. What should I do if I cannot afford car insurance in California?

If you are struggling to afford car insurance, you may be eligible for the California Low-Cost Auto Insurance Program, which provides reduced-cost insurance to income-eligible drivers.

5. Can my car insurance rates increase due to accidents or violations?

Yes, if you are involved in an accident or receive a traffic violation, your car insurance rates may increase. Insurance companies consider these incidents as an increased risk, leading to higher premiums.